is mortgage life insurance mandatory in canada

Buying a home is a big deal. Mortgage Loan Insurance is a Canadian program implemented as a requirement associated with mortgage loans when the down payment is less than 20 of the total cost of.

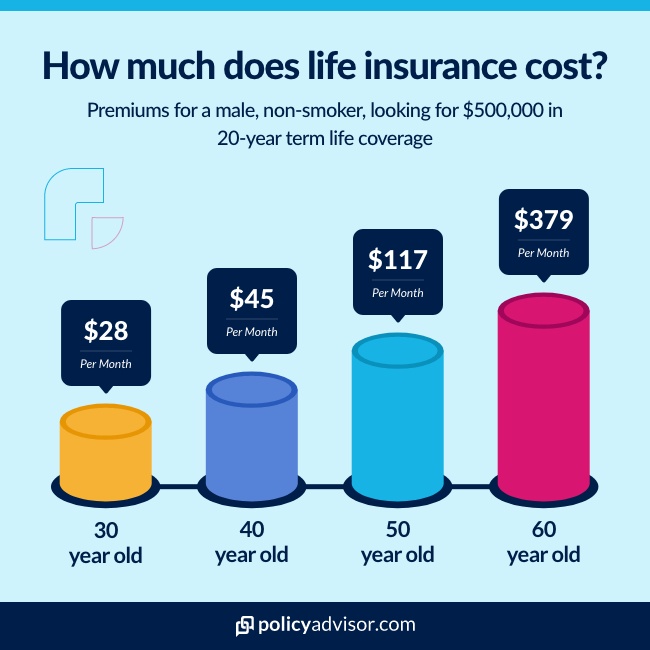

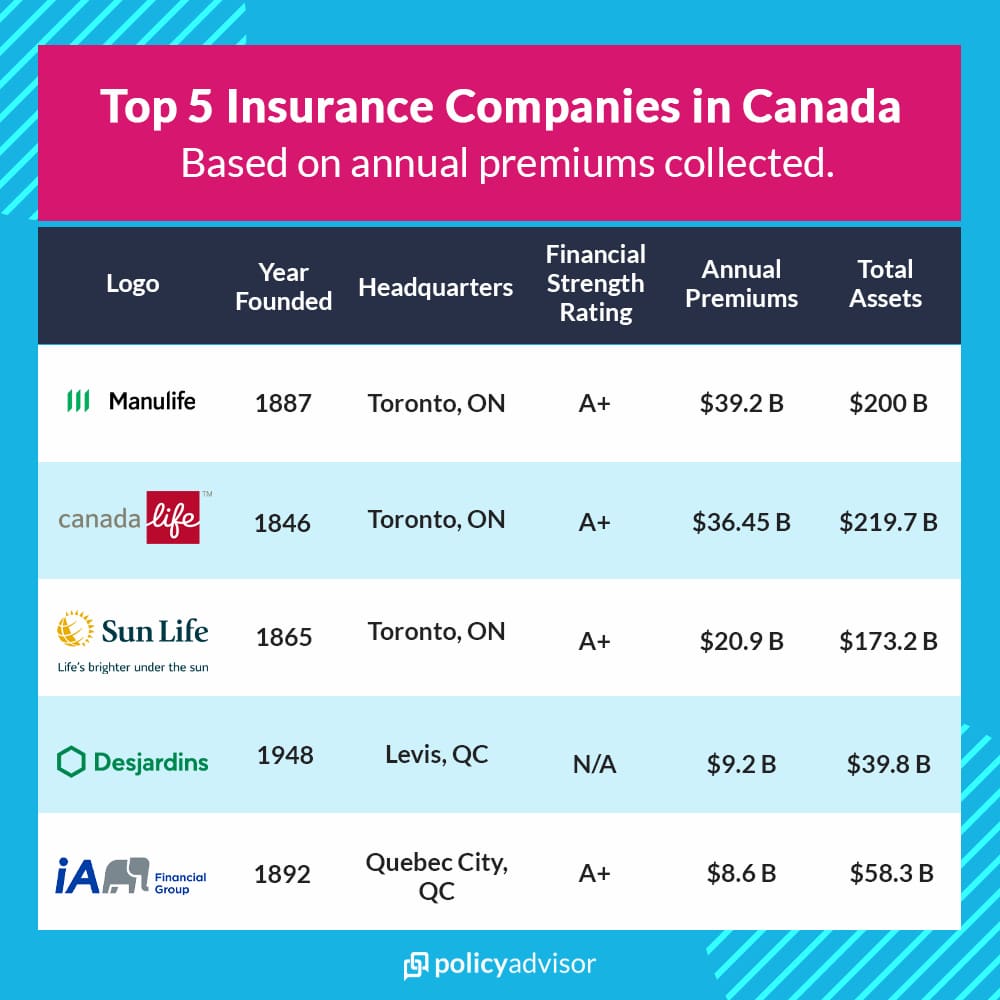

How Much Does Life Insurance Cost In Canada In 2022 Policyadvisor

Learn how mortgage life insurance works in Canada.

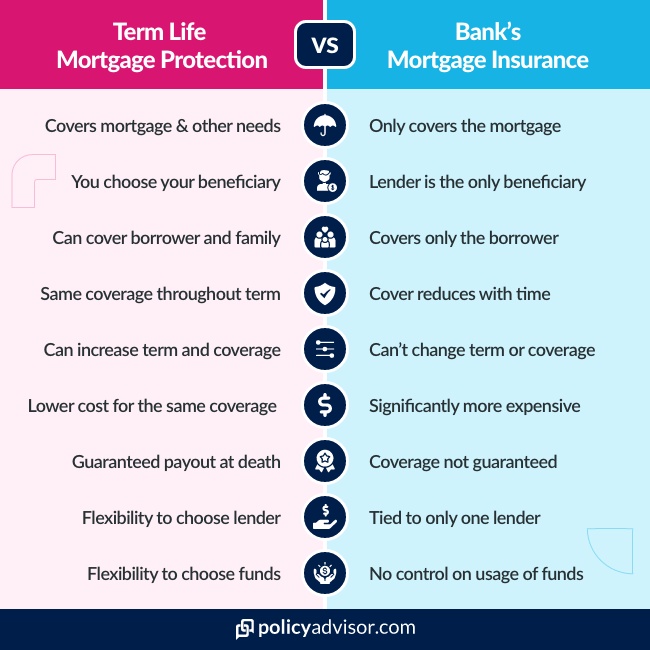

. Personal life insurance coverage meanwhile typically stays the. Lets take a look at the differences between Mortgage Life Insurance and Life Insurance purchased directly through an insurance company. Experts estimate the average home price in Canada is over 700000.

It protects the banks loan to you so if you die your mortgage is paid. But as a high-risk borrower with mortgage insurance you are more likely to get the mortgage approved. Mortgage life insurance is set up to cover the outstanding balance of your mortgage.

Insurance isnt mandatory if you are a buyer in this category. Your mortgage insurance premiums do not change though. In Canada the amount of your down payment will determine if you need mortgage default insurance and how much youll pay.

Mortgage insurance like CMHC Mortgage Default Insurance is required when a down payment is less than 20. All groups and messages. That is a lot of.

Ad Compare 2022s Best Life Insurance Providers. Ensure your mortgage is covered if you pass away. Ad Get a Free Quote Now from USAs 1 Term Life Sales Agency.

In Canada the insurance is paid in full when the borrower gets the mortgage. 2022s Top Life Insurance Providers. Mortgage life insurance is not mandatory in Canada.

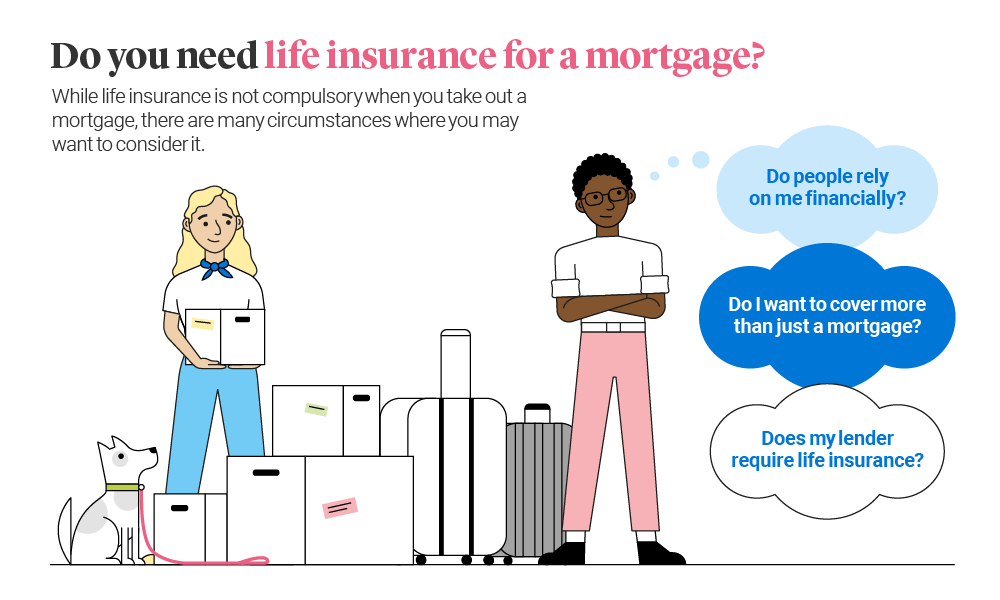

There are better options available to. In Canada prospective homebuyers are not required to have life insurance in order to be approved for a mortgage. Compare Plans to Fit Your Budget.

Premiums vary from 060 - 450. However the two are entirely different types of insurance policies. No mortgage life insurance is not mandatory in Canada.

To protect your family. In Canada mortgage protection insurance is not mandatory but it can help safeguard your family against unforeseen mortgage costs in the event that you pass away or. That said we highly recommend.

It is an option for those that would like to protect their family or beneficiaries from existing mortgage debt however. That being said it is a good idea to think about securing some. Voluntary code of conduct.

In short no Mortgage Insurance is not mandatory in Canada but some financial institutions may require it in order to approve your mortgage. Yes you do. Mortgage life insurance covers the balance of your mortgage which decreases as the mortgage is paid down.

Mortgage life insurance works by paying off the mortgage in the event the borrower dies. The minimum down payment requirements are as. Reviews Trusted by 45000000.

No it is not mandatory to take mortgage life insurance when you set up your mortgage with a lender. Canadas banks have agreed to be bound by a voluntary code of conduct that obliges them to provide clear understandable. Reviews Trusted by 45000000.

Mortgage life insurance is a type of life insurance policy that is specifically designed to pay off outstanding mortgage debt or a portion of it in the event of the mortgage holders death. Well look at this. Furthermore they may need to buy mortgage default insurance if they put down.

Homebuyers will need to buy home insurance if they want a mortgage in Canada. Ad Secure your familys financial future with term life insurance with Ethos. Flexible coverage with prices that fit your familys needs and budget.

That said its smart to think about what might happen if you cant pay your mortgage. These are common on high-ratio mortgages a loan that is higher than 80 of the lending value of the property. Skip to main content.

Home insurance is not legally required in Canada if your house is fully paid for but you will need to purchase home insurance in order to get a mortgage. Mortgage loan insurance is mandatory if you have less than 20 down payment to purchase a home and this insurance protects the lender if you default on payments. As an alternative to mortgage insurance a simple term life insurance also shown on the chart will preserve its full.

Is mortgage life insurance mandatory in Canada. Fortunately mortgage life insurance is not mandatory in Canada.

![]()

Best Life Insurance Companies In Canada 2022 Guide Protect Your Wealth

.jpg)

Get A Life Insurance Quote Instantly 100 Online Policyme

How Much Does Life Insurance Cost In Canada In 2022 Policyadvisor

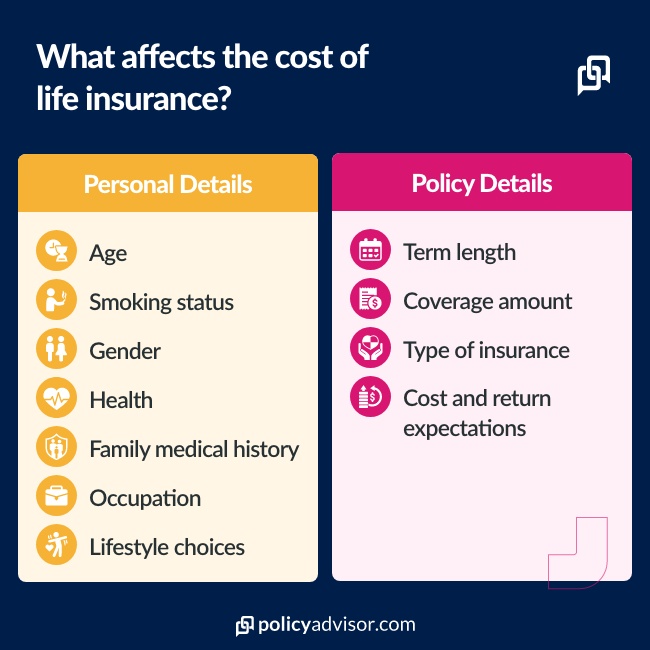

What Is Mortgage Insurance Updated 2022 Policyadvisor

Top Insurance Company In Brampton Mississauga And Gta Nearby Life Insurance Quotes Life Insurance Critical Illness Insurance

International Life Insurance Plans For Expats And Global Citizens

Life Insurance Company Offers Range Of Tools Life Insurance Premium Calculator To Help Life Insurance Calculator Financial Decisions Life Insurance Companies

Is Life Insurance Taxable In Canada Moneysense

Do I Need Life Insurance For A Mortgage Legal General

Best Life Insurance Companies In Canada 2022 Guide Protect Your Wealth

Best Life Insurance Canada 2022 Company Reviews Policyadvisor

What Is Mortgage Insurance Updated 2022 Policyadvisor

![]()

Permanent Life Insurance Universal Life Vs Whole Life Vs Term 100 2022 Protect Your Wealth

/dotdash-life-vs-health-insurance-choosing-what-buy-Final-b6741f4fd8a3479b81d969f9ea2c9bb3.jpg)

Life Vs Health Insurance Choosing What To Buy

Best Life Insurance Canada Reviews Updated 2022 Policyme

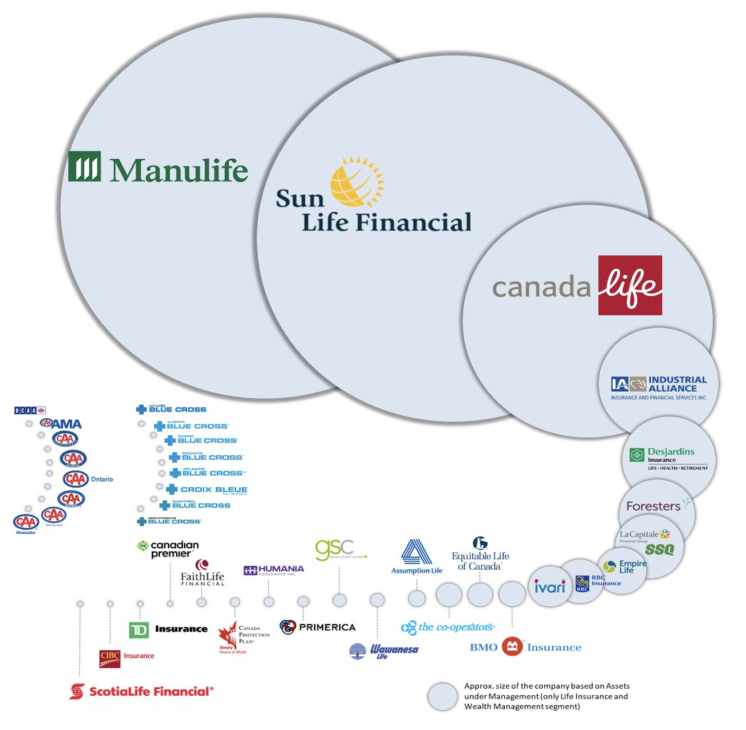

Life Insurance Companies In Canada Full 2020 List

Best Life Insurance Canada 2022 Company Reviews Top 10

Income Position Work Life Balance Wfg Working Life Work Life Balance Life Insurance Premium